by Trevor Rocious

Since the world is completely taken over by scientific inventions. Everything is deeply affected by this dominance. It has also left deep impacts on finance. The traditional finance measures are no longer considered adaptable. Because of the advent of certain easy-to-use tools and tactics, finance has seen a new way of evolution. This evolution has taken up many forms.

Contents

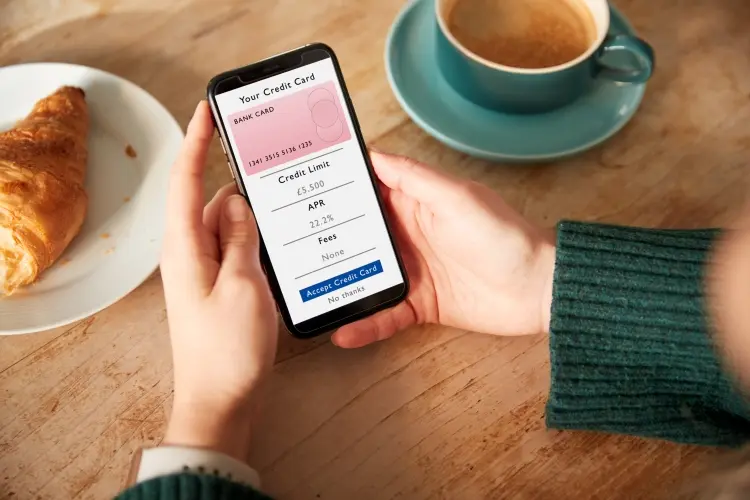

But eventually, the form that we prefer and are well aware of is the usage of credit cards. Credit cards have changed the concept of traditional money exchange in between users. They have facilitated the users to get rid of paper money and access to their favourite items anytime, anywhere. This makes it easier for users to be free of certain money-related obligations. Being handy and quite easy to use, they are still disliked by many experts on a larger scale. They have their own reasons for the dislike they have. Meanwhile, they put the argument that in terms of credit cards, excessive care is a must. Yet, according to a research that was conducted on financial studies. About two third of the population in the US currently think of credit cards as their very basic requisite. According to the results obtained, almost 45% of the population is of the opinion that credit cards actually facilitate. Nearly 45% of the population thinks of them as the best alternative to paper money. 7% think that they are actually a danger to the economic future. Since, they can prove themselves as the all time replacement of paper money. 3% put their statement as an uncertain one. The results of these studies actually proves that most of today's generation thinks of them as the most advantageous financial tool. But, every good thing has a bad side too. This bad side can actually be avoided by maintaining care and being a bit conscious. We all know that we can't survive without credit cards. But do you know that we actually commit certain serious mistakes that can actually make our experience worse. Hereby, we are going to tell you some of the common mistakes we all make in the duration of the credit card validity. We bet you will be amazed at the far-reaching consequences these mistakes actually leave. So, grab your popcorn ladies and gentlemen. Because, this is going to be a serious accountability session. (serious coughs initiated)

Since we all know with great names come great responsibilities. Same is the case with credit cards. Though, they are easier to use as compared to paper money. But, don't go on this excellent feature alone. They have their own consequences too. The credit card debt is a must to be paid. We all know that. But, this credit debt comes with a very sky-high interest rate. This interest rate develops high and high as long as you don't keep your balance low. The debt increases as you keep your balance on pending. This is a habit of most of the people. We all ignore the debt and keep on spending more than the limited utilization rate. You need to be very careful in regard to this. Because, when you keep on increasing the debt. You are recognised as a card defaulter. This situation can create very negative impacts on your credit score. You need to keep a check on your paying habits. If you think that you are not into saving for your balance. In other words, if you think you cannot pay your debt on time. Keeping it minimal and avoiding the pain of late makes us impossible for you. Then, a serious suggestion is you should no longer use a credit card. Because, it is going to add nothing but debt on your head. Still you cannot go for the final verdict. You can never claim that, "Credit cards are just a waste of time and resources". This cannot be thought of as a genuine opinion. Because, they are a very great mode of payment, if handled with care.

As human beings, we all love to seek convenience. We sense ease and crave for it in any form. We all more often pay a very little sum of money as credit debt. Don't believe this? Go have a look at your credit card statement. This is one big reason for people complaining about their debt getting high out of nowhere. The real culprit is no one else but you yourselves. We all in the beginning ignore the payment of the right proportion of debts. Later on, when the balance gets too high on us. We complain. The fault lies in the way of payment. Paying the minimum amount of debt every month can benefit you temporarily. But it is in the back end, making things difficult for you. When your balance cycle will only consist of low lying payments and more expenditures. Alongside the debt, the interest rates are also going ro elevate. Always try to pay more sum than the required one. Try to pay as much as you can. This will save you from trouble payments in future. As it is a saying, "A stitch in time, saves nine".

Whenever you pay late, you must be familiar that a high amount is charged as a penalty. This penalty, better referred to as, "late fee" can burdenize you a lot. Because, it is never the late fee alone. But the interests also double-up with late payments. The credit companies usually charge up a late fee as high as $29 to $39. This should be noted here that this amount is free from the interests. Interests make it further high to almost $59. So, be careful about making timely payments. If you lack a sharp memory. Leave it on to the financial tracking apps such as Personal Capital. They can keep a fine check about the payments you are going to make. They also remind you 48 and 24 hours respectively before the payment. Setting up a reminder on your calendar is also a great option. You can also add your payment days in the bill pay checklist. This will assist you to pay on time.

In order to get the most, we all love to maximize the value of our credit card. But, on an honest note, it is very dangerous to max out a credit card. Because exceeding your credit limit can badly affect your credit score. It is because of the following obvious reasons

When you try to maximize the credit limit, it is going to increase the down debt for you. Since, you are trying to get maximum credit at once. You have to pay a very high cost for it.

When the debt exceeds more than the due limit. You are supposed to pay all at once. This, obviously is not possible. So, it is going to devastate your credit report for you, adding more negatives than positives. The final outcome of which we all are already familiar with. A negative credit score.

Once you are categorized as a bad points holder in the accounts. You are ruined. You cannot think of applying for any lease, rent or mortgage in near future. Because, we all know exactly how it is going to turn. A big mess and a no of course.

So, we all know that stepping out of the assigned limit is going to turn into something worse than a nightmare.

Many credit card users, from their past harsh experiences know well about charging off your debt. When as a credit card user, you fail to pay off your debt till 180 days. They charge off your debt. Though, it seems tempting. But, to clarify this a bit, it isn't tempting at all. First and foremost reason is the direct negative score on your credit report. This score lasts up to 7 years on all the further reports. In other words, you can not think of accessing any monetary projects in the next 7 years. Even after these 7 years, you have to make partial payments to take off that negative score. This is not the only bad thing associated with a charge off. But another bad news is it is never going to save you from paying off. Though, for the creditor requirement, a debt is temporarily charged off. Yet, the company can approach you anytime legally. Because, the statute of limitations as decreed by your state allows them to do so.

When you are about to choose a credit card. Go for the one that offers you with most rewards. Because, many credit cards have cash back or coupon rewards attached with them. These rewards are actually advantageous for you. They pay you back 1% of the total purchases you make. The cash rewards card offers up to 2% of the cash back at any purchase. Using reward granting credit cards for paying for your grocery, gas and billing can be extremely helpful for you.

The next time you are about to use a credit card, think of these important steps you need to be careful about.

About Trevor Rocious

Trevor Rocious is a prominent science blogger known for his engaging and informative content in the field of scientific exploration and discovery. With a passion for unraveling the mysteries of the universe, Trevor has captivated a wide audience with his ability to communicate complex scientific concepts in a relatable and accessible manner.

|

|

|

|

Great Science Topics

Come here for FREE Gifts. We want to share some nice tips and great tricks. First, disable your adblocker for them

Once done, hit anything below

|

|

|

|