by Trevor Rocious

If you are a student, the necessity of having a good credit card history might not excite your interests in the way that it should. You might think that it is unnecessary to get yourself a credit card issued, because what's the need right now? You're right! Indeed, you don't need it right now, but another truth is that you will need a good credit history later as you walk down the path of life. Life doesn't stay the same. It is always getting more complex with each step that you take.

Contents

To make it simple for you to understand the importance of issuing yourself a credit card now without wasting any more time, let us tell you some of the very basic reasons that you'd need to have a good credit history for. Keep reading!

Shortly, you might need to ask for a loan. It can be a car loan, personal loan, mortgage and other. Having a credit card history can make a difference by playing an important role in making the authority takers approve or deny your request. If you have a good credit history, reviewers will approve your loan request in no time. It can also make you eligible for low interest on the money that you'd take a loan.

When you're an adult, and you need to find a place of your own where you can live independently, having a good credit history can make the procedure very easy for you. When you are looking to live in an apartment as a tenant, the owner of the place would like to review your credit history to make sure that you'd be able to pay the rent in the future. This can affect the decision of the landlord, whether he wants you to be his tenant or not. Having a credit card history will help the landlord in trusting you. Otherwise, you'd have to convince him by signing the formalities such as introducing a proxy who agrees to pay the rent just in case you can't. Nowadays, not everyone has someone that'd do it for them. Why take any risk?

Usually, utility companies review the respective person's credit card history. If you have a bad or no credit card history at all, it might affect their opinion about you. This may lead to utility companies to require a deposit from you. Believe us when we say that you don't want to be in such a formality!

We all have dreams. But not everybody gets a chance to live them. Don't ever let anything come between you and the achievement of your dreams! Imagine getting an interview call from the company that you always dreamt of working for, how great that'd be? You would try your best to impress the interviewer. Acing the interview will be your priority. But, what if the company's HR takes a look at your credit card history makes them change their mind about hiring you. How would it feel? Trust us, you don't want to experience that feeling!

You might not want to work under someone. If that's the case, you should look forward to becoming a businessman. However, keep in mind that you need to have a very good credit card history to impress the investors enough that they should be willing to invest in your business.

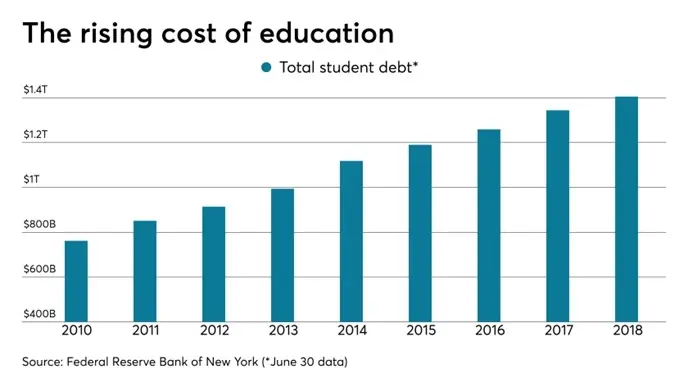

Here is a graph to show you how high the student debts rate has become over the past decade:

Aren't these reasons enough to emphasis the importance of having a good credit card history? Don't worry! It's never too late to start! We are here to help you out at every step of your life! If you have made up your mind to issue yourself a student credit card, then keep reading! We are going to tell your top picks of student credit cards that can help you in achieving every goal of your life in the upcoming future!

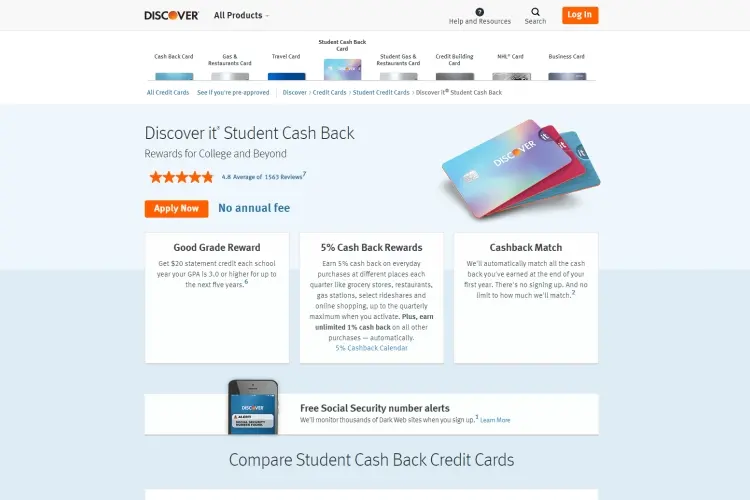

If you're a college or university student, and it's your first time at getting a credit card issued to yourself, then this is the best one for you! It has all that you're looking for in a credit card company to offer you.

To give you a better insight, we have mentioned some amazing benefits of having a Discover it® Student Cash Back credit card. We want the best for you!

· Protection from Fraud and Scam

Discover keeps up with the safety of its users. If you have a Discover credit card then you don't have to stress over taking care of your account and protecting it from scam and fraud. Discover has got you covered!

· Get a Bonus by Referring your Friend

By referring your friend, you can always earn $50 as a bonus. Not just one, but you can refer up to 10 friends per year. That makes a total of $500 of a bonus. You can have it all by yourself! All that you'd need to do is refer your friends, and pray for them to get approved. That's it! Whereas, if your friend makes a purchase or transaction within the three months of creating the account, they can also earn a bonus of $50! So, are you ready to party with your friends?

· Good Grade reward

If you are good at studies then this is your chance! If you're not, then here's your chance to get motivated, because discover is letting you earn an amazing reward of $20 every year you receive a GPA of 3.0 or above! What else are you looking for? Go and make avail of the offer now!

This is our second best pick for you to choose from as your first-ever credit card as a student! This is not a pick that we made out of the blue! We researched enough, just to make sure that we pick the best for you! Some of the benefits that you'd get as a student credit card holder of Deserve® are mentioned below.

· Safer Terms for Cardholders

Compared to other basic credit card companies, Deserve® has safer terms and conditions for cardholders that are new to it. Because you are still a student, Deserve® understands that you might not be able to make a lot of money and keep with the card savings a lot. This is why it has let go of the penalty payment. You don't have to worry about the huge APR striking on unaffordable levels.

· Low Interest on Loan

If you ever need a loan, other credit card companies will charge you a considerable amount of interest. However, if you hold a Deserve® account, you don't have to worry about the huge interest anymore! Deserve® understands you! It charges a very low interest on student loans. What else are you looking for?

· No Need to have a Credential History

Deserve® doesn't need you to have a credential background. It is okay if you don't have any! It is not going to affect the approval of your application request!

· International Students

Not just the US-based students, but international students can also apply for the Deserve® EDU MasterCard for Students.

Here is a video description of this card:

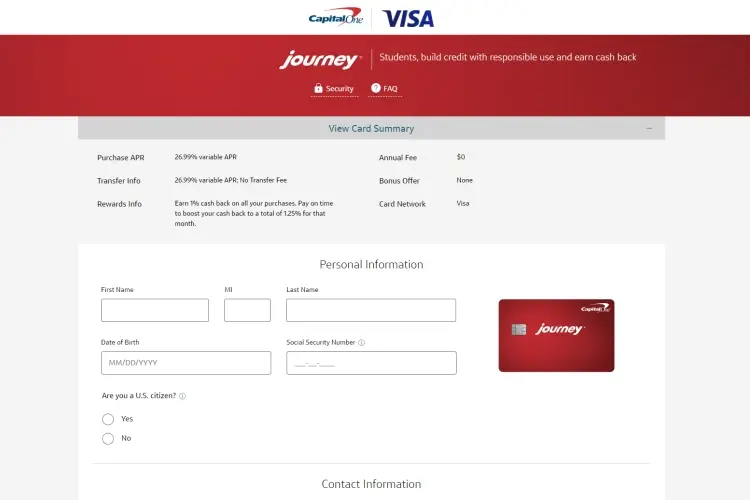

Here are some of the ways that holding an account in the respective credit card company can be beneficial for you:

· Extended Warranty

If you make a purchase completely by the Journey® card, then it implies the extended warranty on your card. If it is an eligible purchase, then you can the manufacturer's warranty will be doubled up by an additional year.

· Fraud protection

If someone misuses your credit card and makes unauthorized purchases on your behalf, you won't be held accountable for it. Make sure that you report the fraud actions as soon as possible.

· Higher Credit Line

If you make your initial 5 payments on time, you will get successful access to a higher credit limit. All credit card companies don't offer you such benefits. However, you can avail one by applying for the Journey® card now!

Other Credit Cards for Students in 2023

If you couldn't pick any one from our top 3 credit card suggestions, then you can have a look at the list of other credit cards that we have created for you. You can choose any one of these and begin your experience of being a credit card holder as a student now!

| Our pick for the best-secured card for you. | |

| If you are looking for a credit card with limited credit access, then this one is for you! | |

| By using this credit card, you can make avail of big rewards on small purchases! | |

| Simple and valuable! It can serve you as a wholesome! |

Here is a video that you can watch to know more about the best credit cards for students in 2023:

We tried our best to make you realize the need for issuing yourself a credit card as soon as possible! Not just that, but we also made sure that we suggested the best of all credit cards that are available for students. Hopefully, you have applied for a credit card till here!

If you found this guide helpful, don't forget to share it with your friends and family who are students. Let them know the importance of having a good credit card history and how it can affect their future decisions.

Thank you! Happy Living!

About Trevor Rocious

Trevor Rocious is a prominent science blogger known for his engaging and informative content in the field of scientific exploration and discovery. With a passion for unraveling the mysteries of the universe, Trevor has captivated a wide audience with his ability to communicate complex scientific concepts in a relatable and accessible manner.

|

|

|

|

Great Science Topics

Come here for FREE Gifts. We want to share some nice tips and great tricks. First, disable your adblocker for them

Once done, hit anything below

|

|

|

|